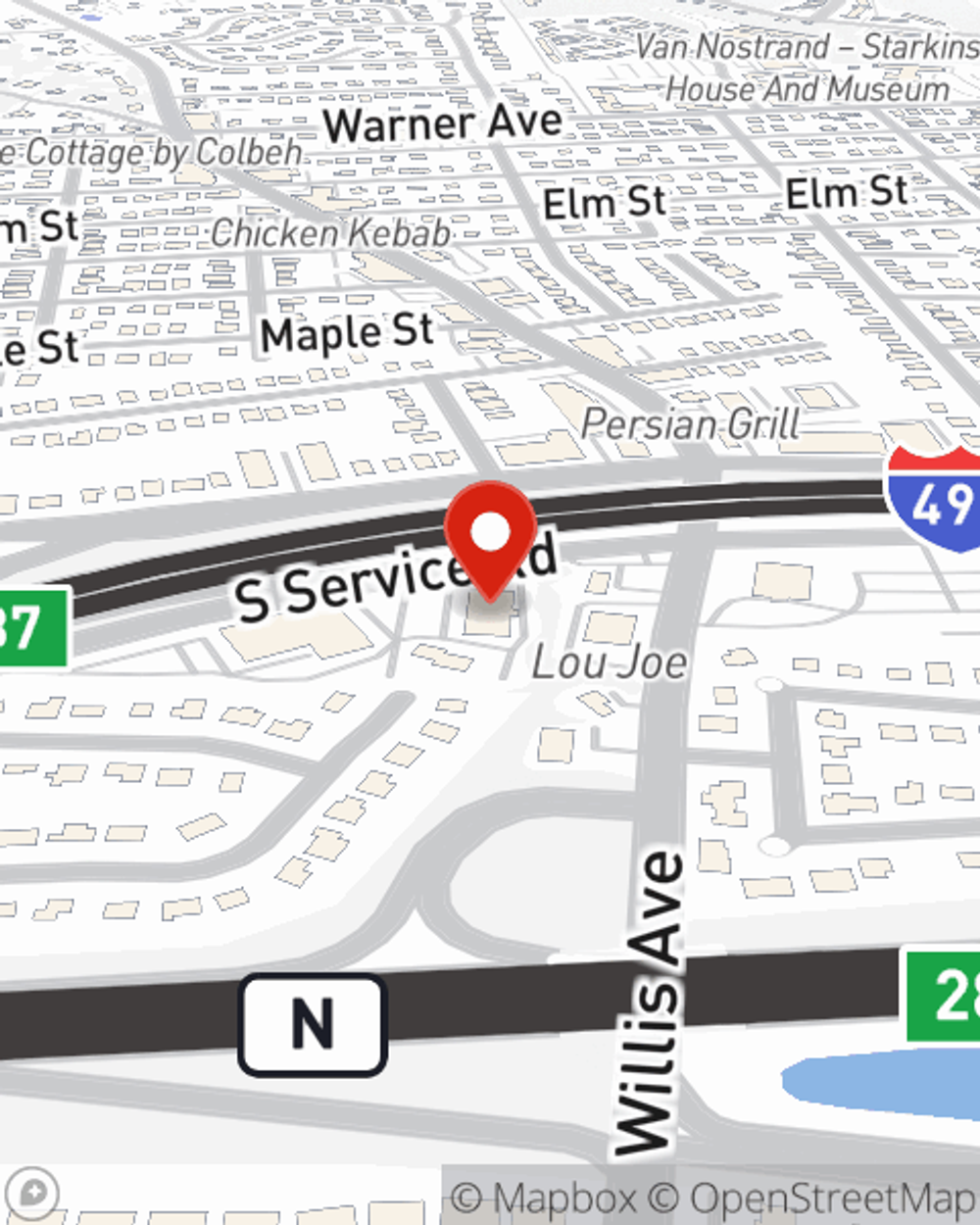

Life Insurance in and around Roslyn Heights

State Farm can help insure you and your loved ones

Now is a good time to think about Life insurance

Would you like to create a personalized life quote?

It's Never Too Soon For Life Insurance

People choose life insurance for several different reasons, but the goal is always the same: to secure the financial future for your partner after you're gone.

State Farm can help insure you and your loved ones

Now is a good time to think about Life insurance

Why Roslyn Heights Chooses State Farm

But what coverage do you need, considering your situation and your loved ones? First, the type and amount of insurance you apply for can be designed to fit your current and future needs. Then you can consider the cost of a policy, which depends on your current age and the age you are now. Other factors that may be considered include lifestyle and personal medical history. State Farm Agent Litza Casinover can walk you through all these options and can help you determine what will work for you.

It's never a bad time to make sure your loved ones have coverage against the unexpected. Reach out to Litza Casinover's office to explore State Farm's Life insurance options.

Have More Questions About Life Insurance?

Call Litza at (516) 277-2636 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

What to consider when choosing a beneficiary for life insurance or other financial accounts

What to consider when choosing a beneficiary for life insurance or other financial accounts

Learn what factors to consider when choosing a life insurance beneficiary or a beneficiary for other financial accounts.

Questions to ask your insurance agent

Questions to ask your insurance agent

Insurance needs are ever-changing. Here are some questions to ask an insurance agent to start the conversation and further explore your coverage options.

Litza Casinover

State Farm® Insurance AgentSimple Insights®

What to consider when choosing a beneficiary for life insurance or other financial accounts

What to consider when choosing a beneficiary for life insurance or other financial accounts

Learn what factors to consider when choosing a life insurance beneficiary or a beneficiary for other financial accounts.

Questions to ask your insurance agent

Questions to ask your insurance agent

Insurance needs are ever-changing. Here are some questions to ask an insurance agent to start the conversation and further explore your coverage options.